Renters Insurance in and around Troy

Troy renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Calling All Troy Renters!

Home is home even if you are leasing it. And whether it's a house or a condo, protection for your personal belongings is beneficial, especially if you own items that would be difficult to fix or replace.

Troy renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

State Farm Has Options For Your Renters Insurance Needs

Many renters underestimate the cost of refurnishing a damaged property. Your valuables in your rented condo include a wide variety of things like your stereo, bed, set of favorite books, and more. That's why renters insurance can be such a good choice. But don't worry, State Farm agent David Basch has the personal attention and dedication needed to help you examine your needs and help you protect yourself from the unexpected.

Don’t let the unknown about protecting your personal belongings make you unsettled! Reach out to State Farm Agent David Basch today, and explore how you can save with State Farm renters insurance.

Have More Questions About Renters Insurance?

Call David at (248) 822-2086 or visit our FAQ page.

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

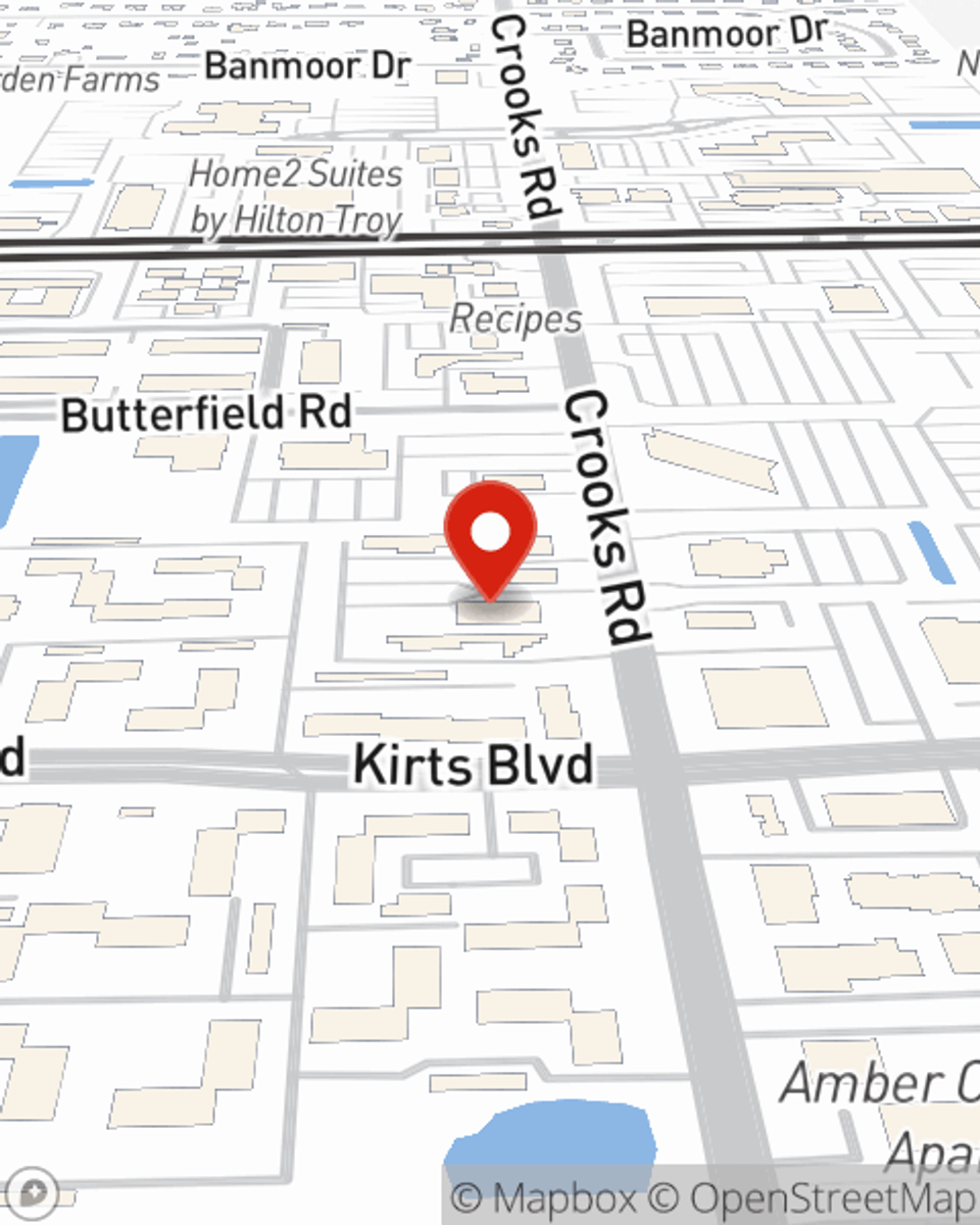

David Basch

State Farm® Insurance AgentSimple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.